In the last couple of weeks, we have understood breakout strategies and how to scan and trade them.

Today, we’ll continue with intraday scanning for breakout strategies and today’s scan is one of my favourite strategies.

Gap & Opening Range Breakout

The Opening Range Breakout is not only popular but an excellent strategy with proven results for intraday traders who especially use 5-10-15 minute charts. Combine this with a Gap opening and you only increase your probability of success.

This style of trading will fit in well with you if you can

- make quick decisions with entries and exits

- trade futures, and

- extremely well disciplined with managing risk on your account.

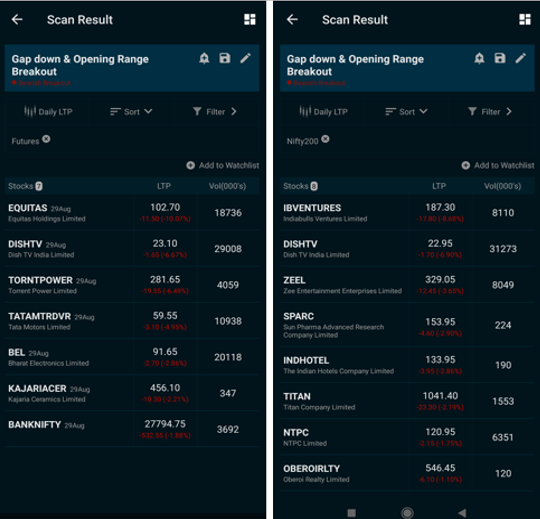

To understand its use, let’s run this scan on the Nifty 200 and Nifty futures see the results.

As you can see the results can be a little different in stocks and futures. This could be due to several reasons, like

- Premium/discount in futures compared to stock.

- Corporate Action

- Supply/demand mismatch in early trades

The best picks are those stocks that appear on both lists. However, it is always better to analyse the charts of the scan results before taking a trading decision.

Defining The Opening Range

The opening range is the high and low of a given period after the market opens. This period is generally the first 15 minutes of trading. Some traders to use higher time frames like 30 mins or an hour as well.

Defining Gap Up/Down

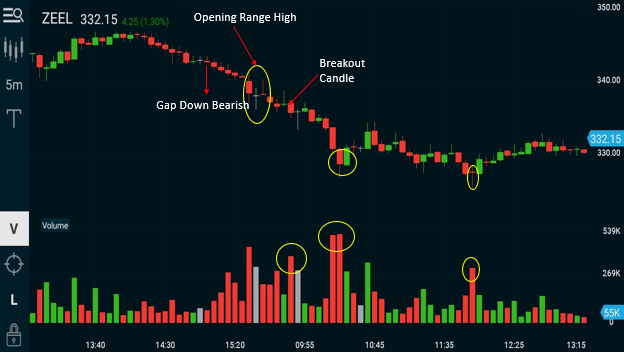

The Zee chart shows price has gapped down this morning by 0.55, i.e the difference between the closing price yesterday (340.50) and the opening price this morning (339.55).

A necessary condition is that today’s open is lower than yesterday’s low (340.00) which is also satisfied.

In the case of Gap up openings, today’s open should be higher than yesterday’s high.

The Breakout

In the ZEEL chart below, after the Gap Down, the Opening Range Breakout (ORB) occurs at 9.45 AM. The stock breaksdown below 336.10, hits a low of 334.90 and closes at 335.80. The volume is good.

You will take this trade at the next candle open at 335.65 with a stop loss above the day’s high at 341.40. The risk is Rs. 5.75 on the trade. I would target a profit of 1x to 1.5x of my risk so say in the range of Rs. 6-9. Once it crosses my 1x target, I will protect my profit with tighter stops. You could also choose to book partial profits and trail a stop for larger gains if you are trading multiple lots. I leave that judgement to you.

The low of 326.10 at 10.20 AM was a good level to exit. There was another opportunity at 11.55 AM when the low was 325.25 which shows a Doji with high volumes, both signal a reversal could be possible.

Important

You must keep in mind a few pointers when you take these breakout trades.

- Always take the breakout trade in the direction of the gap. If the stock has gapped up, take a long trade, when the stock breaks above the opening range.

- If the stock gaps down, take a short trade, when the stock breaks below the opening range.

- If you prefer to take a counter trend trade, you risk ending up on the wrong side during a pullback. To minimise this risk, wait for a confirmation by allowing the breakout to occur first and fail, before entering the position. We’ll discuss this in detail in a future article.

- Ensure there is sufficient volume when the breakout happens. However, extremely large volume can signal exhaustion and low volume shows disinterest, and are both not preferred.

- The earlier in the day the breakout occurs, the better. Tread with caution if breakouts occur later in the day as the volumes may be lower.

- Always use a hard stop loss order when trading this strategy. The ideal stop loss should be at least the low of the opening range for a bullish breakout or the high of the opening range for a bearish breakout. Some traders prefer to account for the gap or the midpoint of the gap in the stop loss to keep a better margin. This decision for me would depend on the gap, size of the range and my risk to reward ratio for the trade.

- Avoid taking the trade, if either the gaps or the opening ranges are extremely large. This would mean you’ll be risking way more than you could possibly make on the trade. It’s just not worth it.

More coming your way, we cover Narrow Range Strategy next week.